Category: Stocks and Investing

Category: House and Home

Category: House and Home

Category: Media and Entertainment

Category: Media and Entertainment

Category: Politics and Government

Category: Science and Technology

Category: Politics and Government

Category: Politics and Government

Category: Politics and Government

Category: Sports and Competition

Category: House and Home

Category: Sports and Competition

Category: Science and Technology

Category: Business and Finance

Category: Business and Finance

Category: Automotive and Transportation

Category: Media and Entertainment

Category: House and Home

Category: Health and Fitness

Category: House and Home

Category: House and Home

Category: House and Home

Category: House and Home

Category: Politics and Government

Category: Stocks and Investing

Category: Sports and Competition

Category: Science and Technology

Category: House and Home

Category: Automotive and Transportation

Category: House and Home

Category: Automotive and Transportation

Category: Automotive and Transportation

Category: Business and Finance

Category: Sports and Competition

Category: House and Home

Category: House and Home

Category: Health and Fitness

Category: Sports and Competition

Category: Travel and Leisure

Category: Food and Wine

Category: Media and Entertainment

Category: Science and Technology

Category: Politics and Government

Category: Stocks and Investing

Category: Food and Wine

Category: Politics and Government

Category: Food and Wine

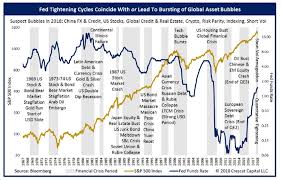

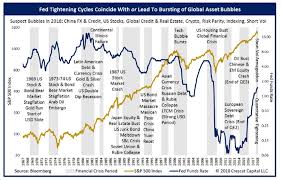

Fed's Tightrope Walk: Inflation vs. Recession

news4sanantonio

news4sanantonioLocales: Texas, UNITED STATES

SAN ANTONIO - January 31st, 2026 - The Federal Reserve's monetary policy continues to be a dominant force in global financial markets, significantly impacting investment strategies across the board. For nearly two years, the central bank has pursued a course of interest rate hikes aimed at curbing persistent inflation. While initial indicators suggest inflation is cooling, the ripple effects of these actions are still being felt by investors in stocks, cryptocurrency, bonds, and other asset classes. The delicate balancing act between controlling inflation and avoiding a deep recession remains the central challenge.

The Fed's Tightrope Walk: Inflation vs. Recession

The Federal Reserve operates under a dual mandate: price stability and maximum employment. The recent surge in inflation, initially fueled by pandemic-related supply chain disruptions and increased demand, forced the Fed to prioritize price stability. Raising interest rates is a key tool in this fight. Higher rates increase the cost of borrowing for businesses and consumers, theoretically reducing spending and slowing down economic activity, thereby alleviating inflationary pressures. However, this strategy inherently carries the risk of triggering an economic slowdown, potentially leading to a recession. The current debate among economists revolves around whether the Fed can achieve a "soft landing" - bringing inflation under control without causing a significant recession.

Stocks: A Volatile Landscape

Equity markets have experienced considerable volatility as investors grapple with the implications of the Fed's policies. Higher interest rates translate to increased borrowing costs for companies, impacting their profitability and future growth prospects. This often leads to lower stock valuations, particularly for growth stocks which rely heavily on future earnings potential. Furthermore, higher rates make bonds a more attractive alternative to stocks, potentially drawing capital away from the equity market.

"We've seen a distinct shift in investor sentiment," explains David Wiser, a seasoned financial advisor at SecureFuture Investments. "The era of 'easy money' is over. Investors are now much more focused on fundamentals - earnings, cash flow, and long-term sustainability. We're seeing a flight to quality, with investors favoring established, profitable companies over speculative ventures."

Recent data suggests a slowdown in corporate earnings growth, further fueling market uncertainty. While some sectors, like energy, have benefitted from the inflationary environment, others, like technology, have faced significant headwinds.

Cryptocurrency: A High-Risk Asset Under Pressure

The cryptocurrency market, already known for its volatility, has been particularly susceptible to the impact of rising interest rates. As the Fed tightens monetary policy, investors tend to reduce their exposure to riskier assets like cryptocurrencies in favor of safer havens. This "risk-off" sentiment leads to selling pressure and declining prices. The appeal of crypto as a hedge against inflation has also diminished as real interest rates (nominal interest rates adjusted for inflation) turn positive.

"Crypto is still considered a highly speculative asset," Wiser notes. "When rates go up, the opportunity cost of holding non-yielding assets like Bitcoin becomes more apparent. Investors are asking themselves, 'Why take on that much risk when I can earn a decent return on a relatively safe investment like a Treasury bond?'" The lack of widespread regulatory clarity and continued security concerns further exacerbate the risks associated with crypto investments.

Bonds: A Renewed Appeal

Bonds, traditionally considered a safe haven, have experienced a resurgence in popularity as interest rates rise. Bond yields move inversely to bond prices; as the Fed increases rates, bond yields increase, making bonds a more attractive income-generating asset. Investors are increasingly drawn to the predictable returns offered by bonds, particularly in an environment of heightened market volatility. However, it's crucial to remember that bond prices can still fluctuate based on interest rate expectations and credit risk.

Navigating the New Normal: Investment Strategies for 2026

Given the current economic landscape, what should investors do? Wiser emphasizes the importance of a long-term perspective and a diversified portfolio. "Panic selling is rarely the answer. Investing is a marathon, not a sprint. It's essential to remain disciplined and focus on your financial goals."

He recommends the following strategies:

- Diversification: Spread your investments across different asset classes (stocks, bonds, real estate, commodities) to reduce overall risk.

- Focus on Quality: Invest in companies with strong fundamentals, consistent earnings, and healthy balance sheets.

- Consider Value Stocks: Value stocks, which are typically undervalued by the market, may offer better protection against downside risk.

- Rebalance Regularly: Periodically rebalance your portfolio to maintain your desired asset allocation.

- Seek Professional Advice: Consult with a qualified financial advisor to develop a personalized investment plan tailored to your specific needs and risk tolerance.

The Federal Reserve's actions are likely to continue shaping the investment landscape for the foreseeable future. Staying informed, adopting a long-term perspective, and seeking professional guidance are crucial for navigating these challenging times and achieving your financial goals.

Read the Full news4sanantonio Article at:

[ https://news4sanantonio.com/money/investing/federal-reserve-impact-on-stocks-crypto-other-investments ]

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing